Why is a budget so important?

When it comes to a monthly budget it is not a one size fits all. Every budget should be custom tailored to each individual or couple. Everyone who has any kind of income is also likely to have bills. It is important for all of us to know how much we are making and how much our bills are to make it through an entire month. This is why it is so important for all of us to make a budget for our monthly expenses.

It’s not complicated

Without a budget our finances can get out of hand quickly. Our money runs out too soon and our bills go unpaid or even forgotten about. The thing about budgeting is, it’s not complicated if we follow some basic principles. As for the gentlemen reading this, your lady will also find more security when your finances are in order.

In this article we will discuss what the proper way to budget looks like and how budgeting is a key component of wealth building. Also, we will discuss one bonus tip that nobody ever talks about. Spoiler alert….this one thing that you can do with your budget is so beneficial, you will feel much more relaxed with your finances than you did before.

Be realistic

As we have already talked about, budgeting is not complicated. Although, there will be things that you are going to want to keep in mind. Having a plan that makes logical sense is the key. This is the time to be very realistic with yourself about how much you make, how much you must pay monthly, and how much you can afford to do those other fun things that you enjoy doing.

Treat yourself but do it wisely

It’s ok to have some pocket money to do stuff like date nights, girls/guys night out, eating out or whatever, but don’t go crazy here. Remember you have a plan, and you have to seriously look at what you can afford. You have to see when everything else is said and done in the budget before you know what you can spend to have that fun. Having a well-planned out budget that you actually stick to, and knowing how much you can spend on the things that you like to do, will ultimately make your fun time even more enjoyable.

Why is debt bad

Looking at your debt is essential. Debt is a common problem in our culture, and it kills our true wealth building potential. Think of debt to be something like this. You could be investing that money or paying bills with it, but instead you have to give that money to your debt. Your money becomes enslaved to the debt until the debt has been paid in full and only then is your money free again. Once that money is free, you can now put it to a better use to help build the future for you.

There are a lot of you out there that do write down or use a program to achieve a monthly budget. For budgeting programs, we recommend using YNAB or Everydollar.

Where did all the money go

Maybe a lot of people reading this are still wondering where all their money went even though they had a budget. So, let’s discuss that for a minute. A poll in Nerdwallets article called Most Americans Have a Monthly Budget, but Many Still Overspend stated that “84% of Americans said they have gone over on their monthly budget.”

Well, the good news is, at least 84% of Americans are budgeting according to this poll. The article went on to state that “48% percent used credit cards for additional purchases when going over budget.” Another recent article on Intuits website states that “65% of Americans do not even know how much they spent last month.” Now we are getting somewhere. That 84% does not look so pretty now.

Stay in control

The key to successfully budgeting and wealth building is discipline and patience. Without discipline, money just seems to disappear even though it’s budgeted and without patience your money will not have time to grow. You can’t plant a tomato seed today and pick juicy tomatoes tomorrow. It just doesn’t work that way.

According to a survey credit.com stated that “27% of Americans don’t think they need a budget.” Some other people may say they make too much to care about it or don’t make enough for it to matter. The basic idea of budgeting is for any age or any stage. If you make money, then you should have a well-planned out budget. A monthly budget is a big key to managing finances and building wealth. Everyone can do this successfully if they really want more financial freedom.

Put every dollar to work

Keep this in mind as you make your monthly budget out. For monthly expenses every dollar is a soldier, and a group of soldiers is an infantry. You want your infantry to attack where the threat is aka your bills and debts. Without a budget the infantries will just fall apart. Your dollars will lose focus and disappear. Orchestrating your infantry to attack where you need will turn into a beautiful symphony and you get to be the conductor of that monthly.

You also might be interested in our article called 6 Tips to Build Wealth Like an Everyday Millionaire.

How to make a budget.

Now let’s talk about how a well-planned out budget looks and how to get yourselves in a position to start the wealth building process. Remember to stick around until the end because we are going to give you a bonus tip that will take your budget to a completely different level.

The Zero-Based Budget is simple yet the most versatile budget that can be custom tailored to any financial situation.

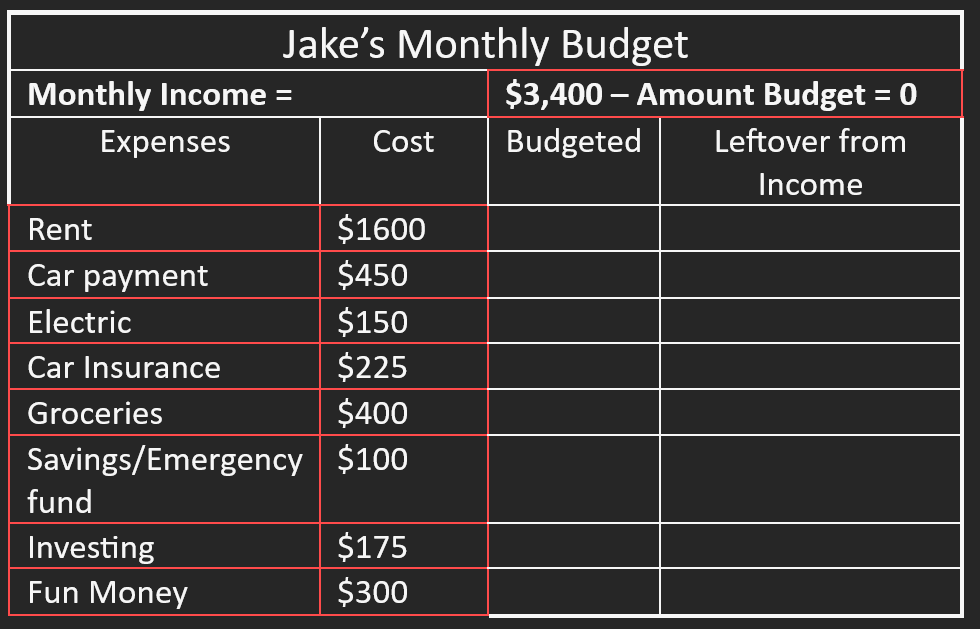

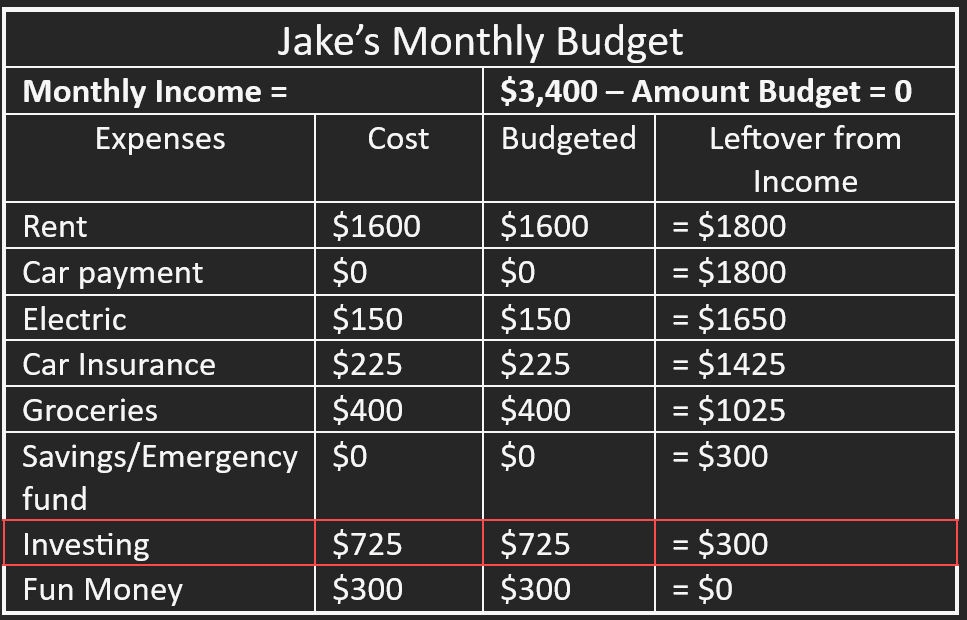

First, write out how much your monthly income is and then create a list of your monthly expenses. Below is a sample budget of Jake’s budget.

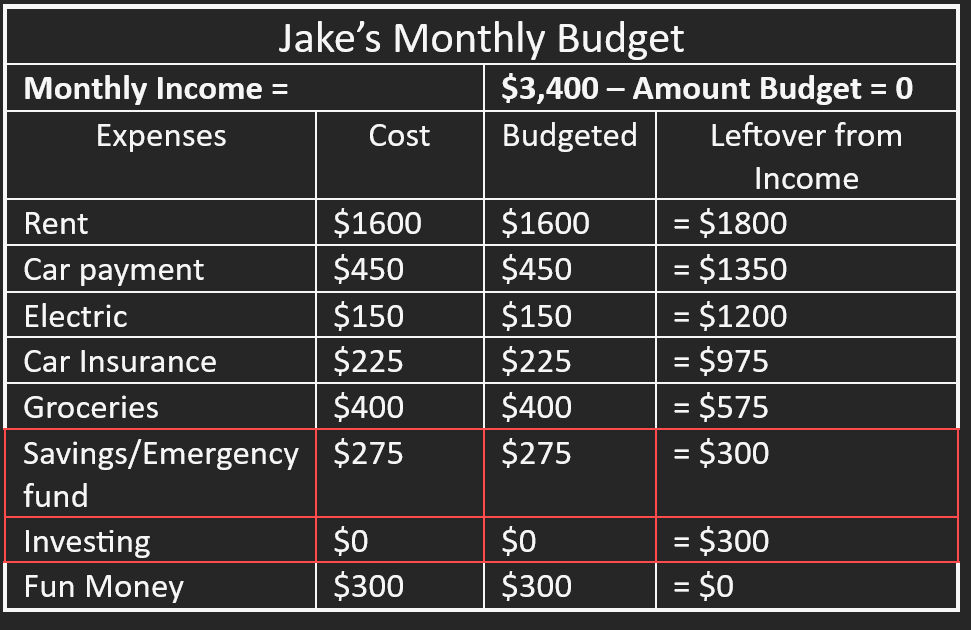

Now fill in the Budgeted and Leftover from Income categories. The amount leftover from your monthly income should get smaller as you fill in the budgeted categories. See Jake’s example below.

What you have left to budget from your monthly income should be zero when you have everything filled out in your budget. This is why it is called Zero-Based Budget. You are giving every dollar a job to do. Just because you budgeted all your income to zero, it doesn’t mean that you don’t have any money. It just means all your money is budgeted and has a place to go. Notice that Jake even gave himself some money to play with.

Let’s take a closer look

Jake’s budget may look a bit normal depending on what area you are living in. Keep in mind that everyone’s budget will look different. Jake’s budget could look a bit better. Let’s look closer at it and see how we can help Jake start building some wealth. Jake is giving $100 to an emergency fund and $175 to investing which is great. Jake is a smart guy by saving and investing but Jake could do better than that.

Stop investing

If Jake was to temporarily stop his investing and move that money to his emergency fund to save up around $1,000, he could get that saved up in just a few months. He just needs a small cushion in his emergency fund to cover small, unexpected expenses for now. He can grow it more later.

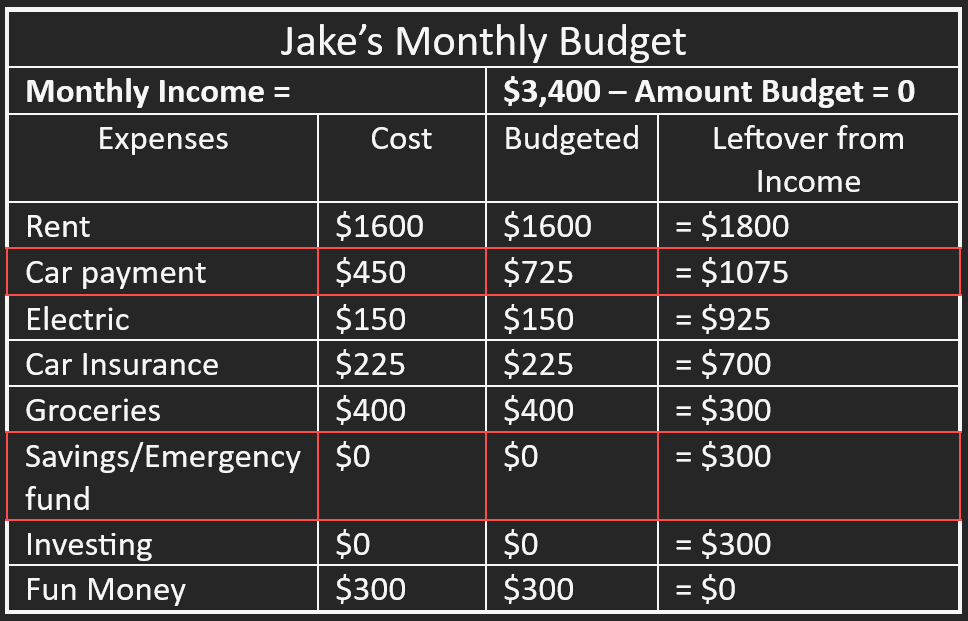

Paying down the debt

Once Jake gets his small emergency fund in place, he can stop contributing to that temporarily. He can then move that $275 that he was contributing to that fund and put it towards his car payment so he can get that debt out of the way and free up even more cash.

Jake could also take on a part time job, create a side hustle, or reduce his grocery budget to help pay off his car even quicker.

Working on the emergency fund

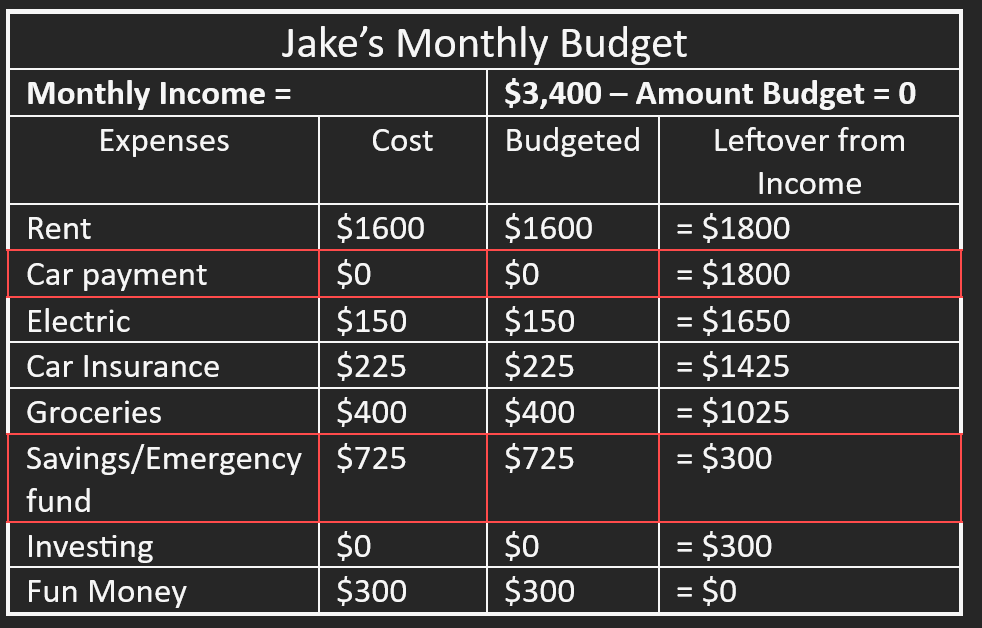

Now once Jake has his car completely paid for, he can now focus on making his emergency fund more robust. He can take all the money that he was giving to his car payment every month and start building up a minimum of three months’ worth of expenses. It will not take long for him to do this now that he is debt free, and he puts in all his free money towards this.

The payoff

After Jake has achieved his emergency fund goal, he can quit funding this category and he can now really start building wealth a lot quicker than he was several months ago. Now Jake has gone from contributing $275 a month to $725 a month in his investing accounts. Jake’s future is looking very wealthy now just by some small modifications in his budget and setting goals for himself.

Jakes’ example of setting goals and making some budget changes to achieve those goals would have only taken him over a year depending on how much he owed on his car and how much extra money he could come up with to put towards that debt. The fact is that everyone’s situation is different. This could take 2 or 3 years depending on how much debt there is to take care of but the work that you will put in and the sacrifices that you will make are very much worth it.

Now the good stuff.

Now for the bonus tip that will change your budgeting game. If this is the only thing that you ever do and you disregard everything else that we just talked about (not recommended), this will give you so much more peace of mind financially as you pay for expenses every month. This gets even better when you work this with everything else that we just went over. Like we discussed before, you will walk a bit lighter step because you don’t have that financial stress weighing you down.

Bonus tip

Here is your bonus tip: Start paying for this month’s expenses with last month’s income. Think about it. If you saved up one month’s worth of income and kept that in your checking account, then at the first of every month you could make out a full budget for the whole month. You already know to the dollar how much that you have to spend, and you have been budgeting enough that you can estimate your expenses fairly close. You know about how much your rent will be and you know about what your electric bill will be based off last month’s bill and the current season.

Now relax

Think about how relaxing it would be to get your bills coming in and you just pay them without worrying if the money is going to be there and when you are going to get paid next. The money is already in the bank, and you just pay a bill without even thinking about it because you know that you budgeted for that bill. This is truly how to break the paycheck-to-paycheck lifestyle.

You also might be interested in our article called How to Set Financial Goals and The Benefits of Having Them.